Our approach

Our investment approach is rooted in partnership. We are active and research-driven investors who use a thematic approach to identify areas we think will experience long-term growth. We invest with a flexible mandate and have the ability to provide financing across capital structures.

We are proud to be working on behalf of the more than 559,000 OMERS members who make Ontario’s municipalities great places to live and work.

Where we invest

Life Sciences

We deploy long-term capital, resources, and expertise to support innovative life science companies as they address unmet medical needs and improve the quality of life of patients around the world.

Life Sciences

We deploy long-term capital, resources, and expertise to support innovative life science companies as they address unmet medical needs and improve the quality of life of patients around the world.

Growth Equity

We invest in high-growth companies backed by exceptional entrepreneurs and investors to create companies of the future in software, healthcare, education and fintech. We make minority equity investments and focus exclusively on technology-enabled companies at the Series C or later stages.

Growth Equity

We invest in high-growth companies backed by exceptional entrepreneurs and investors to create companies of the future in software, healthcare, education and fintech. We make minority equity investments and focus exclusively on technology-enabled companies at the Series C or later stages.

GreenTech

We make investments across equity and debt outside traditional categories and asset classes and aim to build a concentrated, global portfolio of investments across high conviction themes including decarbonization and cleantech.

GreenTech

We make investments across equity and debt outside traditional categories and asset classes and aim to build a concentrated, global portfolio of investments across high conviction themes including decarbonization and cleantech.

Investing in the future

Learn about some of the companies in our portfolio that are working to make a better tomorrow.

Aledade

A real partnership for primary care.

Aledade partners with primary care physicians, providing support services and its proprietary, cloud-based data and workflow technology platform. This partnership allows practices to deliver high-quality healthcare to patients, participate in value-based care alternative payment models, and stay independent.

Northvolt

Accelerating change through innovation.

Northvolt was founded to enable the transition to a decarbonized future by supplying sustainable lithium-ion batteries.

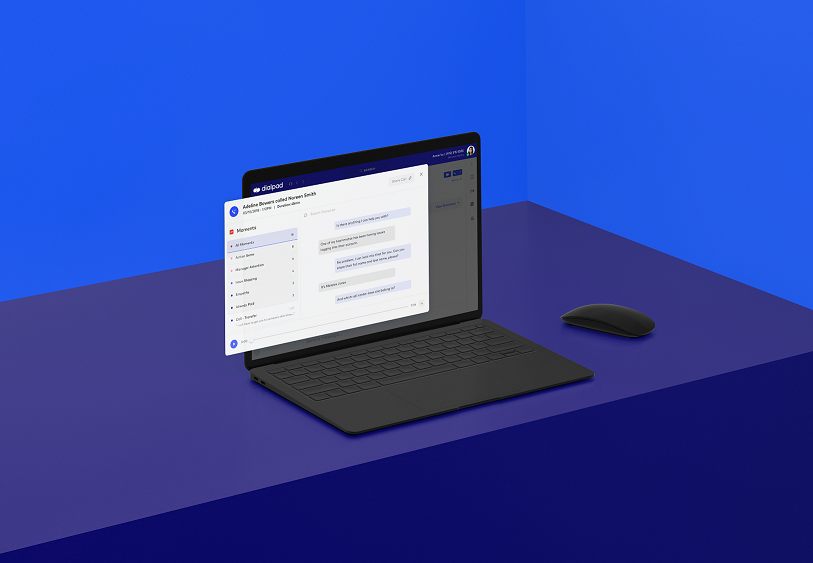

Dialpad

Industry-leading conversational Ai.

Dialpad is a cloud-based multi-medium business communication system and contact center that turns conversations into opportunities and helps global teams make smarter calls – anywhere, anytime.

Working with us

We work closely with our partners to bring to life bespoke growth strategies that create long-term value.